Consumer and Internet

View All Announcements

Our Approach

Partnership Capital

We partner with management teams and provide strategic capital to companies operating across the consumer and internet sectors.

Flexible Solutions

We utilize our flexible capital to make investments supporting organic growth, acquisitions, refinancings, working capital management, and shareholder liquidity.

Domain Expertise

Our team has deep domain expertise and is active across consumer services, multi-unit businesses, franchisor / franchisee, health & wellness, digital marketplaces, e-commerce, consumer subscription, tech enabled consumer, and branded intellectual property.

Consumer Services

Multi-Unit & Franchise

Health & Wellness

Digital Marketplaces & E-commerce

Consumer Subscription

Tech-Enabled Consumer

Branded Intellectual Property

Consumer and Internet

Our Solutions

Growth Capital

We partner with management teams and provide capital to accelerate growth and support strategic initiatives.

Preferred Equity

We offer custom equity financings including convertible preferred equity, redeemable preferred equity, or other equity solutions with the ability to combine these with secured debt financing.

Direct Lending

We provide asset-backed and custom debt or debt-like financing solutions and can tailor terms and structure to provide flexible, rapid, and fully committed financings to meet companies’ unique goals.

Acquisition Capital

We provide companies with committed capital to finance an acquisition or a series of acquisitions. Our solutions can be provided in the form of debt, equity, or a combination of both.

Refinancings & Recapitalizations

We offer flexible debt and equity solutions to replace or augment existing capital structures or to recapitalize companies’ shareholder bases.

SELECT INVESTMENTS

In 2024, Sixth Street co-led a $1.8 billion strategic investment in Equinox, the authority in high-performance luxury living, to refinance maturing loans and to fund general corporate purposes and growth including new clubs.

Learn MoreSELECT INVESTMENTS

In 2023, Sixth Street co-led a significant growth investment in Far West Services, a franchisee of Wingstop restaurants.

Learn MoreSELECT INVESTMENTS

In 2023, Sixth Street co-led a strategic growth equity investment in Milan Laser Hair Removal, the nation’s largest laser hair removal provider, to support the acceleration of clinic expansion, marketing, and business development.

Learn MoreSELECT INVESTMENTS

In April 2020, Sixth Street co-led a $1 billion strategic investment in Airbnb, the trusted global travel experience marketplace, to help strengthen Airbnb’s global community of hosts and guests delivering unique, local, and authentic experiences.

Learn MoreSELECT INVESTMENTS

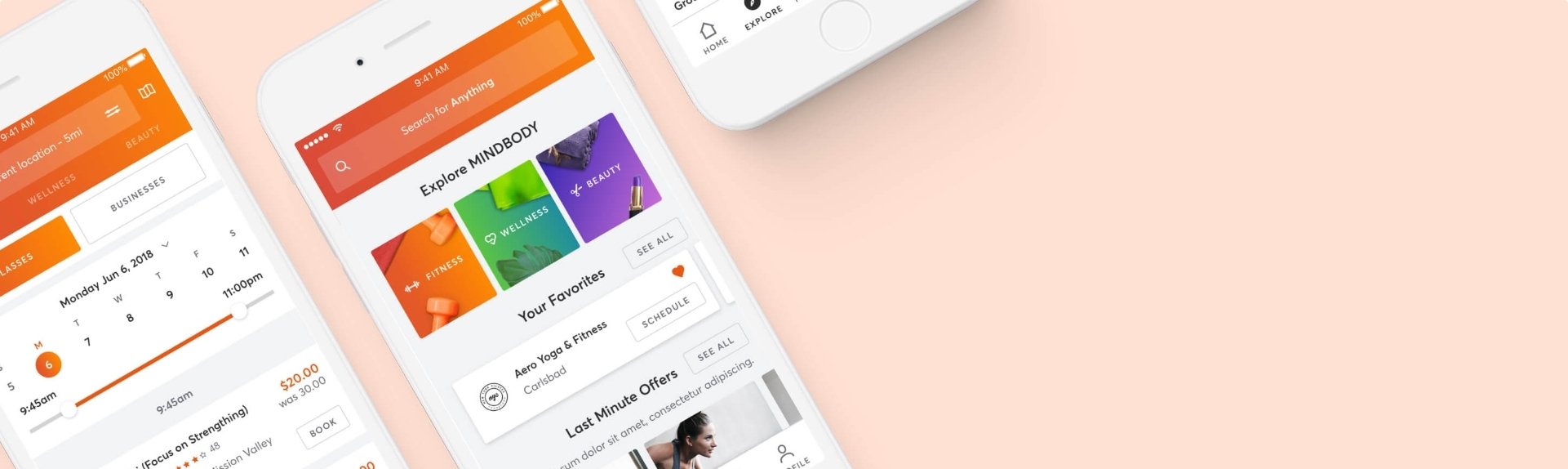

Mindbody is the leading experience technology platform that provides cloud-based online scheduling and business management software for the fitness, wellness, and beauty industries. In 2021, Sixth Street led a $500 million strategic investment as part of Mindbody’s acquisition of ClassPass, creating a one-stop shop for both business owners and consumers.

Learn More