Sports, Media, Entertainment,

and Telecom

View All Announcements

Our Approach

Strategic Capital

We utilize our long-term, flexible capital base to invest in a broad spectrum of sports, media, entertainment, and telecom companies and assets.

Domain Expertise and Broad Experience

Our prior investments in the sector include digital streaming providers, sports team's infrastructure, data and telecom businesses, radio broadcasters, high-growth media companies, digital and traditional gaming assets, as well as software businesses related to the sports, media, entertainment, and telecom sector.

Customized Solutions

We collaborate with management teams to develop custom capital solutions with the goal of balancing near-term liquidity needs with long-term strategic plans. Our partnerships can take the form of structured equity, direct lending, long duration revenue stream transactions, asset purchases, project and development finance, or joint ventures, often to facilitate expansion.

Casinos and Route-Based Gaming

Datacenters

Digital Gaming

Fiber

Media Rights

Online Marketplace Platforms

Spectrum

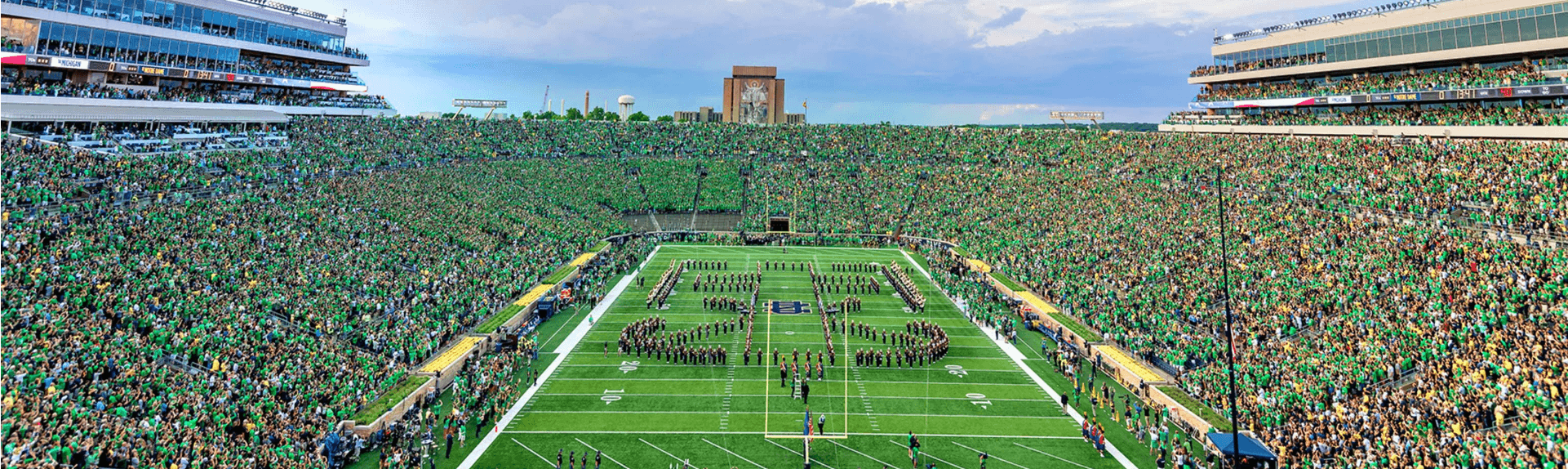

Sports

Subscription Streaming Services

Tower Infrastructure

Traditional and Digital Publishers

Wired and Wireless Service Providers

Sports, Media, Entertainment, and Telecom

Our Solutions

SELECT INVESTMENTS

In April 2023, Sixth Street led the largest institutional investment ever made in women’s professional sports franchise. Bay FC, part of the National Women’s Soccer League, was co-founded by Sixth Street and USWNT legends Brandi Chastain, Leslie Osborne, Danielle Slaton, and Aly Wagner. Other investors include founder of LeanIn.org Sheryl Sandberg and four-time NBA and two-time WNBA Champion Rick Welts.

SELECT INVESTMENTS

In 2022, Real Madrid, Sixth Street, and Legends announced a long-term partnership to elevate the Santiago Bernabéu Stadium as a worldwide benchmark for sports, leisure, and entertainment.

Learn MoreSELECT INVESTMENTS

In June 2021, Sixth Street led a strategic investment alongside Michael Dell in the San Antonio Spurs, one of the most successful and admired franchises in all of sports. Sixth Street became a strategic partner to Managing Partner Peter J. Holt and the Holt family, who lead the team’s investor group, with Sixth Street supporting their vision for the future of the Spurs in San Antonio.

Learn MoreSELECT INVESTMENTS

In the summer of 2022, FC Barcelona and Sixth Street reached agreements for two strategic investments in the Club’s LaLiga TV broadcasting rights. Sixth Street’s investment marked a major step forward in the improvement of FC Barcelona’s financial resources and competitive positioning.

SELECT INVESTMENTS

In 2021, Sixth Street made a majority investment in Legends, a premium experience platform partnered with the most iconic global brands in sports, entertainment, and attractions. Sixth Street leads the Legends partnership group alongside affiliates of the New York Yankees and Dallas Cowboys.

Learn MoreSELECT INVESTMENTS

In February 2024, Sixth Street joined GI Partners as a strategic investor to back Blue Stream Fiber. Headquartered in Coral Springs, Florida, Blue Stream Fiber provides 10-gigabit broadband, as well as video and voice services, over state-of-the-art fiber-optic networks to housing associations and neighborhoods under long-term, contracted bulk service agreements.

Learn MoreSELECT INVESTMENTS

In 2024, Sixth Street announced it was hosting the Soccer Champions Tour for the second year, bringing some the world’s most iconic soccer clubs to the U.S. The Tour will again include a match between the famed rivals, FC Barcelona and Real Madrid, which set the record in 2023 for the highest attended club soccer game at AT&T Stadium with 82,026 fans. Italy’s AC Milan, and England’s Manchester City and Chelsea will also compete in six matches throughout the summer.

Learn MoreSELECT INVESTMENTS

In 2017, Sixth Street co-led a strategic investment in the creation of AirTrunk, an Australian hyperscale datacenter business for cloud, content, and large enterprise customers . AirTrunk was acquired in April 2020 by Macquarie Infrastructure and Real Assets (MIRA) for A$3 billion.

Learn More