Real Estate

View All Announcements

Our Approach

Global Solutions Provider

We are a global property investor and solutions provider across the full range of real estate asset classes: residential, hospitality, office, industrial, and retail as well as niche asset classes. We invest across the capital stack in real estate and sector-related operating businesses. We have deep experience investing in and financing both existing and development assets.

Collaborative, Partnership Capital

We take a collaborative approach and have deep experience working in partnership with real estate operators, borrowers, service providers, and other institutional investors around the world.

Scale and Flexibility

We make scalable commitments ($50m-$1b+) and utilize our flexible mandate to invest across the capital structure including equity (asset and platform level), joint ventures, preferred equity and debt.

Real Estate

Our Solutions

SELECT INVESTMENTS

Seagate

In 2023, Sixth Street (in partnership with Madison Capital) acquired a 575,000 sf / 31-acre office, R&D, and advanced manufacturing campus in Fremont, California from Seagate Technology. The transaction was structured as a sale leaseback to Seagate, in which Seagate leased the strategically important property back on a long-term basis via a triple net lease.

Learn MoreSELECT INVESTMENTS

Red Cove

In 2022, Sixth Street formed a programmatic partnership with Red Cove Capital “RCC” to provide preferred equity/mezzanine debt for multifamily developments, recapitalizations and acquisitions in the United States. Through the venture, Sixth Street is the exclusive capital partner to RCC who leads origination, underwriting, and asset management of the venture’s investments. The venture seeks to capitalize on the housing shortage by providing capital to projects backed by best-in-class developers in favorable markets.

SELECT INVESTMENTS

Oxnard

In 2023, Sixth Street completed the purchase of 60-acres of coastal land Oxnard, California entitled for the development of 292 single family homes. The transaction was completed in partnership with Harridge Development Group, its second venture in combination with Sixth Street. The partnership is in the process of completing horizontal improvements, grading and developing lots for single-family homes.

SELECT INVESTMENTS

Interporto Regionale della Puglia

In 2019, Sixth Street completed the purchase of Interporto Regionale della Puglia, a fully-let logistics park with 90,000 sqm of covered area and intermodal distribution logistics facilities located in Bari, Italy. The hub is strategically located near the port of Bari, and directly connected to the highway and the Italian railway network through its own intermodal freight terminal. The distribution facilities have Class A features and cross docking capacity, with several having controlled temperature capacity.

SELECT INVESTMENTS

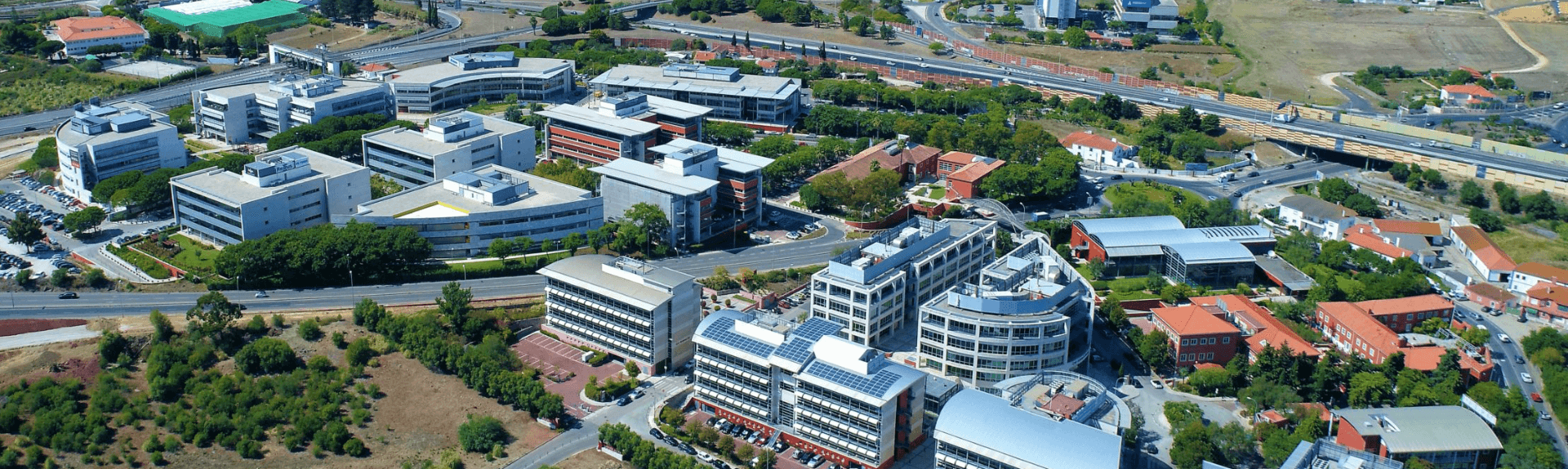

Quinta da Fonte

In 2021, Sixth Street acquired 15 buildings within the Quinta da Fonte Office Park (QDF) in Lisbon’s Western Corridor. QDF is strategically positioned between Lisbon and Cascais at the heart of the capital’s working professional residential neighbourhoods. The office park comprises 80,000 sqm and is a favoured business address for occupiers that are global leaders in biotech, medical diagnostics, pharmaceutical, engineering, financial services, and technology.

SELECT INVESTMENTS

Sardinia

In 2022, Sixth Street acquired the Le Palme Hotel & Resort on the Costa Smeralda in Sardinia, Italy. Sixth Street plans to redevelop the property into a five-star ultra-luxury resort to be operated under a management contract with Rocco Forte Hotels. The new hotel will feature 64 luxury rooms / suites and offer the highest standards of comfort. The hotel will also offer its guests a state-of-the-art spa and the choice of three restaurants as well as a panoramic rooftop bar and private beach, lake and garden.

SELECT INVESTMENTS

In 2017, Sixth Street co-led a strategic investment in the creation of AirTrunk, an Australian hyperscale datacenter business for cloud, content, and large enterprise customers . AirTrunk was acquired in April 2020 by Macquarie Infrastructure and Real Assets (MIRA) for A$3 billion.

Learn More